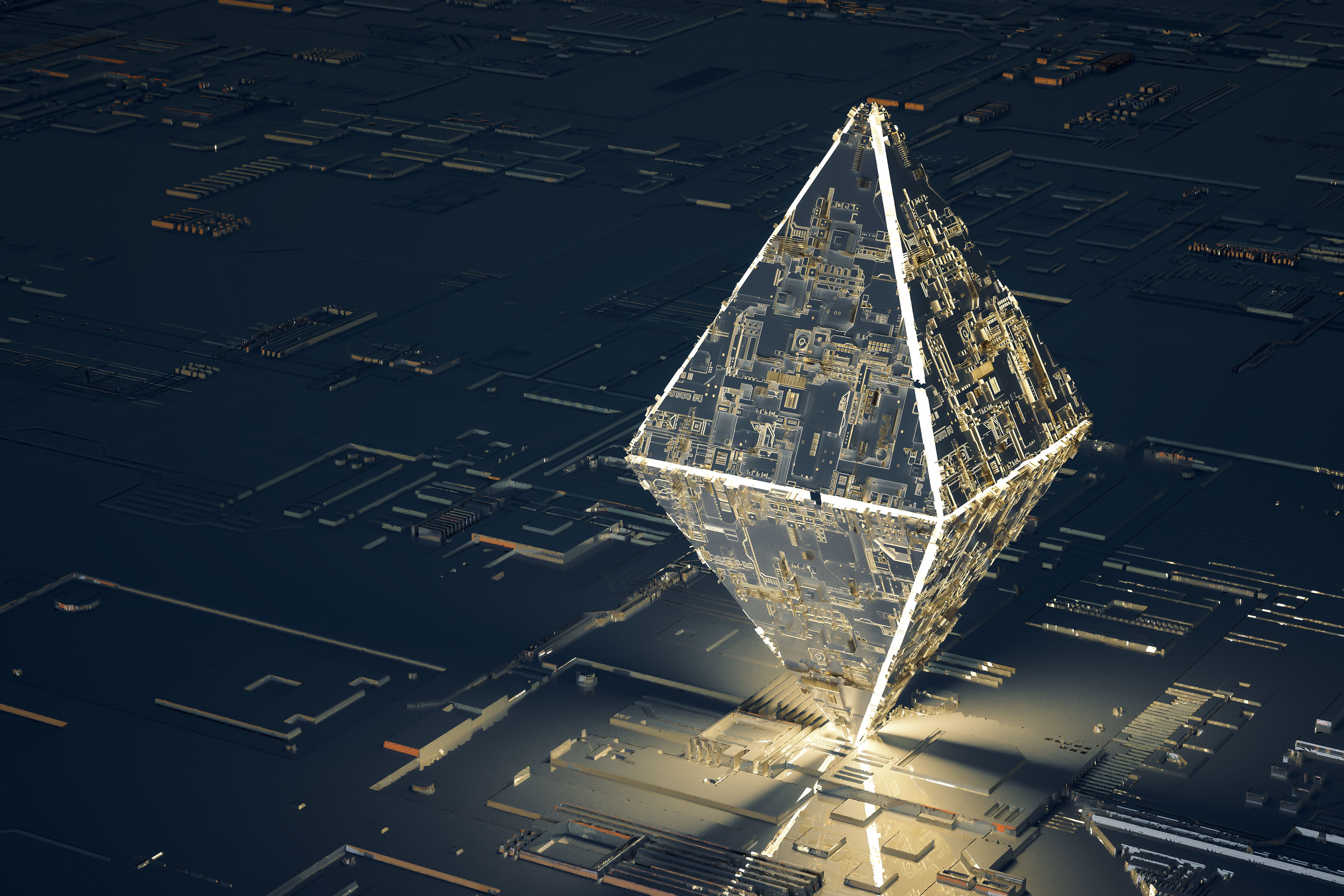

Exploring the Impact of Liquid Staking Derivatives on Ethereum's Decentralization

Understanding Liquid Staking Derivatives

Ethereum's transition to a proof-of-stake (PoS) consensus mechanism has opened up new opportunities and challenges, particularly with the rise of liquid staking derivatives. These derivatives enable stakers to unlock the liquidity of their staked Ether by creating tokenized versions of staked assets. This allows users to continue participating in the ecosystem while their assets remain staked, offering both flexibility and potential financial benefits.

The concept of liquid staking derivatives is gaining traction as it addresses one of the main drawbacks of traditional staking: the illiquidity of staked assets. By providing a derivative token, users can trade or use these tokens within decentralized finance (DeFi) applications, effectively enhancing the utility of their staked assets.

Enhancing Decentralization and Security

One of the primary advantages of liquid staking derivatives is their potential to enhance Ethereum's decentralization. By making staking more accessible and attractive, these derivatives can encourage a broader range of participants to stake their Ether. This, in turn, can lead to a more decentralized network, as the concentration of staked Ether among a few large validators can be mitigated.

Moreover, liquid staking derivatives can contribute to network security. By incentivizing more users to stake their assets, the overall security of the Ethereum network can be strengthened. A more distributed staking landscape can reduce the risk of attacks and increase the resilience of the network.

Challenges and Risks

Despite the benefits, liquid staking derivatives also present challenges. One of the main concerns is the potential for centralization within these derivative platforms. If a few platforms dominate the market, they could concentrate power, counteracting the decentralization benefits. It's crucial for the community to monitor and address these risks to maintain a balanced ecosystem.

Additionally, the complexity of these financial instruments could pose risks to users who may not fully understand the implications. The potential for smart contract vulnerabilities and other technical risks should not be underestimated. Users need to exercise caution and conduct thorough research before engaging with liquid staking derivatives.

The Future of Liquid Staking Derivatives

As the Ethereum ecosystem continues to evolve, liquid staking derivatives are likely to play an increasingly important role. Their ability to enhance liquidity and participation in staking makes them a valuable tool for the growth of the network. However, it will be essential to address the associated risks to ensure that they contribute positively to Ethereum's decentralization.

Looking forward, the continued development and innovation in this area will be critical. As new solutions and platforms emerge, they will need to prioritize transparency, security, and user education to foster trust and adoption among the Ethereum community.

Conclusion

In conclusion, liquid staking derivatives represent a significant innovation in the Ethereum space. While they offer exciting opportunities for enhancing decentralization and liquidity, they also pose challenges that need careful consideration. By understanding and addressing these risks, the Ethereum community can leverage liquid staking derivatives to build a more robust and decentralized network.

The journey towards a more decentralized Ethereum is ongoing, and liquid staking derivatives are poised to be a key component in shaping the future of the network. As stakeholders continue to explore and adapt, this dynamic landscape promises to deliver new possibilities and challenges for the Ethereum community.